The average salary student can earn living in Australia

Australian visa permits a flexible number of working hours for students who have applied to the full-time professional course. Usually, the student will get a part-time work permit during the academic year and a full-time work permit during summer vacation. The Australian government allows students to work 40 hours a fortnight in any kind of job, and the government has given few relations on student visas to address the workforce shortage issue. Though we have got the opportunity to work more hours it is also important to complete all the assignments on time and submit them to keep your grades up, so students need to maintain both work and academic life in balance.

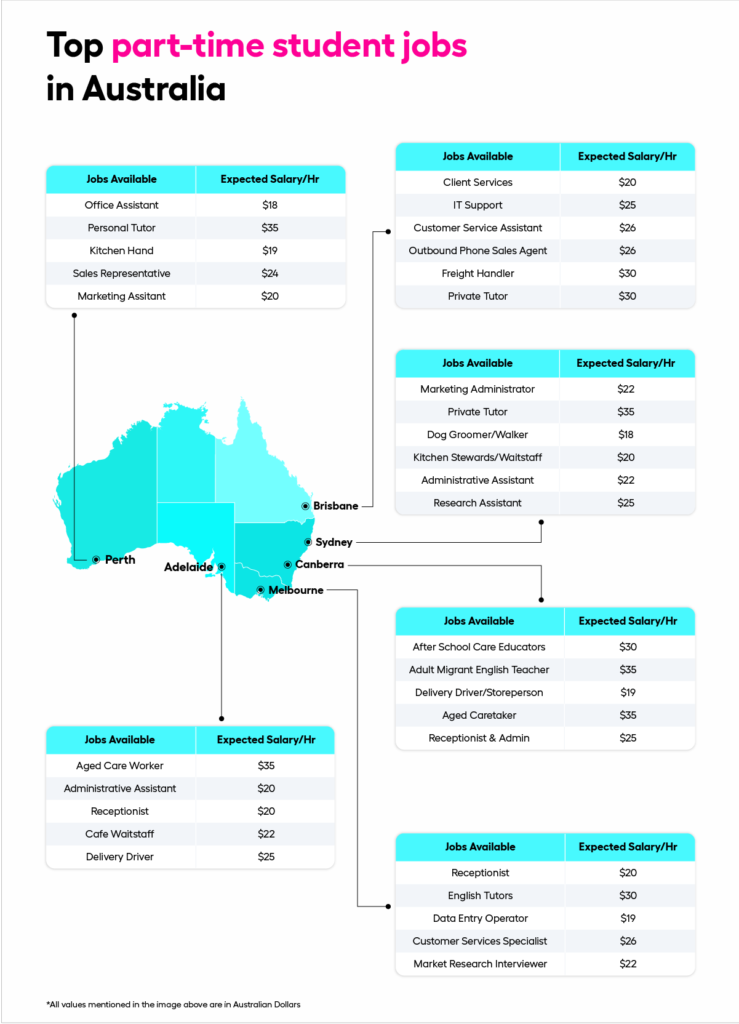

Students have a wide variety of job options in Australia such as administrative work, research assistant work, delivery work, fuel station jobs, data entry jobs, and customer care jobs. The hourly pay will be differing from job to job and based on area, but basic hourly pay in Australia is around 21 to 22 AUD per hour and a student can make 800 to 820 AUD per week working any off-campus and on-campus. Students should find a job based on their location and hourly pay for the job, timings, shifts, and amount of work. The different kinds of jobs in Australia and their roles such as retail store monitoring, jobs in restaurants, bars, sporting venues, food stores, and hotels. We also have service-based jobs like call centers, administration work, supermarkets, and fuel stations and industry-based jobs like warehouse monitoring, and small-scale industries. The different job options based on area and their hourly pay are as mentioned below.

The major thing students should keep in mind is that if their annual income is above 18,200 AUD, they cannot claim a tax refund and will be eligible for tax exceptions on laptops, educational needs, and travel. All these payments and refund processes can be done online using PAYG which is directly connected with the Australian Taxation Office.